- Sears & Kmart – 358 stores in 2017, 63 in January 2018.

- J.C. Penney – 138 stores.

- Macy’s – 68 stores.

- Payless ShoeSource – 800-900 stores.

- Teavana – 379 stores.

- Gymboree – 350 stores.

- True Religion – 27 stores.

- Ascena Retail Group – At least 268 stores.

The most recently publicized closing was Toys R Us which filed for bankruptcy in September 2017. The chain closed all its stores in the following year despite last-minute efforts by Isaac Larian. Larian, the toy executive behind MGA Entertainment, tried to buy the chain first via a $1 billion GoFundMe campaign, then with his own funds putting in a $675 million bid to purchase 274 Toys ‘R’ Us stores, and a separate $215 million bid to buy 82 Canadian locations according to the Los Angeles Times.

Storefronts Still Matter

As difficult as 2017 was for many retailers, all is not lost. Brick-and-mortar locations still matter to consumers. An IHL Group report from August 2017 reported: “retailers are opening 4,080 more stores in 2017 than they are closing and plan to open over 5,500 more in 2018.” Even online brands understand the consumer still likes shopping in stores.

Direct-to-consumer retailers have started to try their hand at opening physical locations. Some of these companies include not only Amazon but also luxury consignment seller, TheRealReal, eyeglasses retailer, Warby Parker, the fine jewelry retailer, Blue Nile and mattress manufacturer, Casper. Online retailers are expanding their reach by opening storefronts because it’s what the consumer wants.

U.S. Census data released in August 2017 reported 90 percent of all retail purchases were made in brick-and-mortar locations during the last quarter. Shoppers still like to see and touch the merchandise and prefer the personal service that can only be provided by an in-store visit. These three retail technologies can help brick-and-mortar retailers increase the personalization of the customer shopping experience.

Clienteling Services

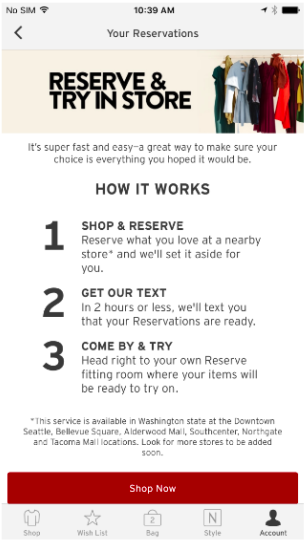

Nordstrom’s Reserve Online & Try In Store service is an excellent example of clienteling at its best. This service lets customers use an app to pick out the items they are interested in, then book a dressing room in a store of their choosing.

Location services let store employees at the customer’s chosen location know when a Reserve Online customer is on the way. A fitting room is made ready for the customer’s arrival complete with the customer’s name on the door.

This service is provided with no commitment to purchase yet according to a Forbes article, 80% of those customers that have tried Reserve Online & Try In Store have continued to use the service.

Online Self-Scheduling

The 2017 Watches & Jewelry report presented an analysis of the online strengths and weaknesses of 66 watch and jewelry brands, including Cartier, Swarovski, Pandora and Tag Heuer. It highlighted that several companies were employing ‘concierge’ methods in an attempt to drive consumers in-store without listing prices. One example included offering online appointment scheduling. They offer online scheduling, allowing ‘concierge’ contact via a web form and providing a phone number to connect the customer to a ‘concierge’.

Kay Jewelers extends a ‘concierge’ service by making available self-scheduling on their website. Customers use a self-scheduling link to book an appointment at a location of their choice based on a zip code. The service provides a convenient way for customers to book a pressure-free appointment with one of their jewelry experts.

Mobile Applications

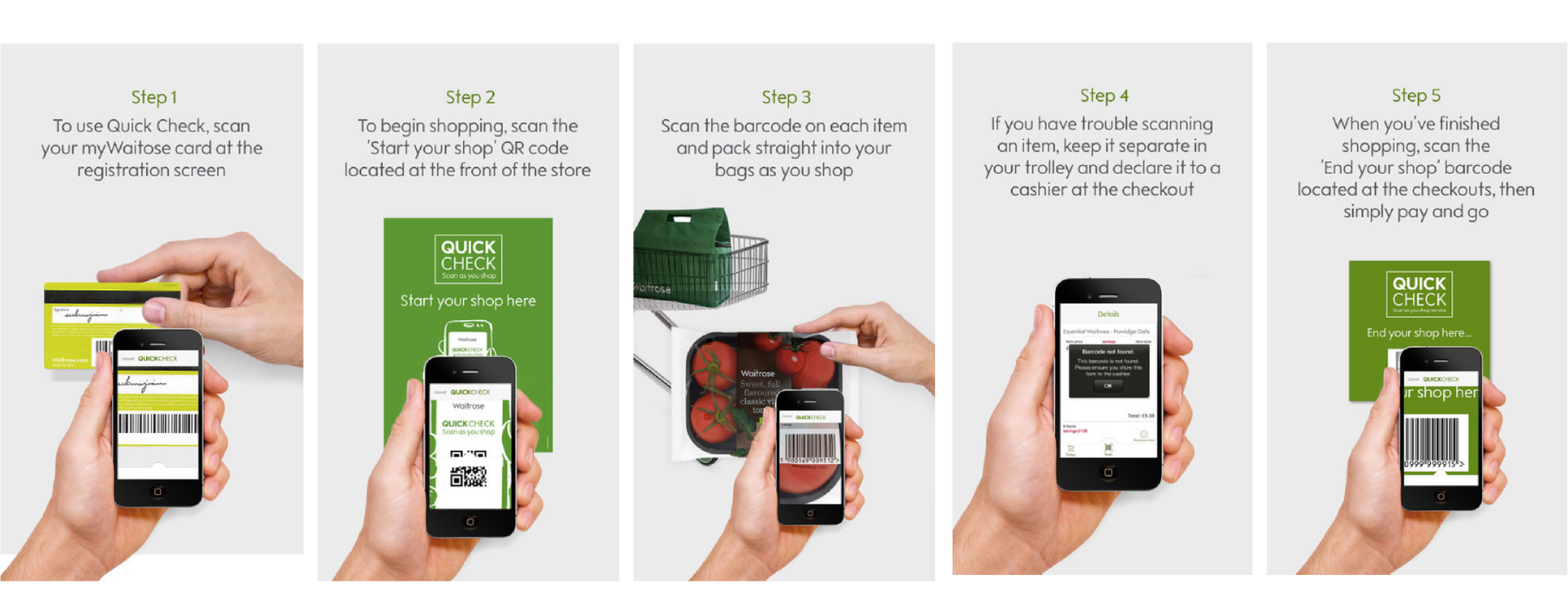

Waitrose’s Quick Check mobile app is targeted at improving the in-store shopping experience. The UK grocery chain’s app lets customers shop using their smartphone’s camera. The customer starts their order by scanning the ‘Start your shop’ QR code at the front of the store. They can then begin their shopping trip, scanning barcodes of the items they want as they take them off the shelf. The customer can even put their items straight into shopping bags, cutting down on time spent unloading a cart and packing bags at checkout. Once the customer is finished shopping, they just scan the ‘End your shop’ barcode, pay at a register, then they are out the door. The app also stores a customer’s loyalty card number so they won’t need to scan their card every time they shop.

Personalization Nurtures the Customer Journey

Salesforce’s Connected Shopper Report reaffirms that the retail consumer is more than open to a personalized experience from a retailer.

- 55% of shoppers say retail experiences are disconnected across channels.

- 63% of shoppers do not feel like retailers know them.

- 58% of shoppers value personalized customer service in-store.

Both the retailer and the customer benefits from the interactions and relationships created using these technologies. Beyond delivering the personalized experience that customers will respond to positively, these technologies are a good way to help bridge the digital customer experience to your physical stores.